Loanz Review, Top Ratings, and Fees in Canada | 2023

Who is Loanz?

Loanz, a convenient online lender, offers personal loans with quick approval and funding in as little as 15 minutes. Founded to provide Canadians with alternative lending options, Loanz eliminates the traditional hurdles associated with loan applications. By utilizing a fully digital process, applicants can easily apply for loans from their computers or mobile devices without the need for physical visits to a lender. The funds obtained from these personal loans can be used for various purposes, including large purchases, urgent expenses, or debt consolidation.

Table of Contents

How does it work?

Loanz specializes in unsecured personal loans, providing borrowers with the following options: loan amounts ranging from $1,000 to $15,000, interest rates between 29.9% and 46.9%, and loan terms spanning from 12 months to 5 years. There are several advantages to working with Loanz. Firstly, the application process is fast and efficient, with online applications leading to quick approval and access to funds within an hour. Secondly, Loanz accepts all credit scores, making it an ideal choice for individuals with less-than-stellar credit histories. Moreover, borrowers have the flexibility to select repayment terms that suit their financial circumstances. Additionally, timely payments on personal loans from Loanz can help improve one’s credit score, potentially leading to better borrowing opportunities in the future with lower interest rates. Furthermore, since these loans are unsecured, borrowers are not required to provide any collateral.

Considerations

However, there are a few considerations to bear in mind when working with Loanz. While you can apply for a personal loan using a mobile device, it is important to note that there is no dedicated mobile app available, requiring applicants to use a web browser instead. Additionally, the interest rates charged by Loanz can be relatively high, reaching up to 46.9%, depending on the individual’s financial profile. As a result, the cost of borrowing a personal loan from Loanz may be significant.

To understand the potential cost of borrowing from Loanz, it is necessary to consider three key factors: the annual percentage rate (APR), the loan term, and the loan amount. For instance, if you apply for a $5,000 loan with a 35% interest rate over a 2-year term, the loan will have the following characteristics:

| Loan Amount | $5,000 |

| Interest rate | 35% |

| Term | 2 years |

| Monthly Payment | $292.59 |

| Total paid | $7,022.23 |

| Total interest paid | $2,022.23 |

How to Apply for a Personal Loan with Loanz

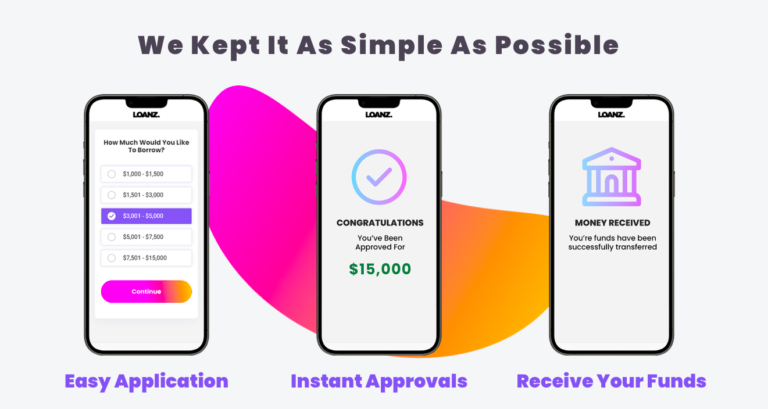

Getting a personal loan from Loanz is a straightforward process. Just follow these three simple steps:

Step 1: Online Application Fill out the online application form, selecting your desired loan amount and term.

Step 2: Connect Your Bank Information You have the option to connect your banking details, which allows Loanz to verify your financial status and eligibility for a loan. Although this step is not mandatory, skipping it may result in a longer processing time, delaying the receipt of your funds.

Step 3: Receive Your Funds Review your loan terms before accepting them. Once approved, you’ll receive your funds. In fact, the funds will be available to you within 15 minutes after approval.

Qualification Requirements for a Loan with Loanz To be eligible for a personal loan with Loanz, you need to meet the following requirements:

- Be of legal age in your province.

- Have an active chequing account.

- Have a steady source of income.

- Not currently in collections or bankruptcy.

Additionally, you’ll need to provide the following documents:

- Government-issued ID.

- Proof of employment status.

- Proof of income.

- Valid Canadian ID card to verify your identity, address, and phone number.

- Bank account information.

Frequently Asked Questions about Loanz

What fees does Loanz charge?

Loanz may charge fees for late or missed loan payments, as well as for non-sufficient funds if automatic payment withdrawals are set up.

How quickly can I get a loan through Loanz?

Loan approval is nearly instantaneous after completing and submitting your application.

Is Loanz a safe platform to use?

All the information you provide during the application process is securely stored, ensuring the protection of your sensitive data.

What can I use my Loanz loan for?

Funds obtained through a Loanz personal loan can be used for various financial needs.

What sets Loanz apart?

Loanz distinguishes itself through its fully digital loan application process. Additionally, quick loan decisions are made, and funds are disbursed within minutes.

Conclusion

Final Thoughts Loanz is an excellent option for individuals who face difficulty obtaining personal loans through traditional channels due to bad credit or other financial issues. If you’ve struggled with loan approvals in the past, Loanz offers a viable solution. However, it’s important to note that the interest rates can be quite high, resulting in a potentially expensive personal loan. Please contact us for a guest post exchange.