2000 Note Ban: Curbing Black Money and Promoting Digital Payments

The INR 2000 note ban, also known as demonetization, was a significant monetary policy move implemented in India in [year]. It involved the discontinuation of the INR 2000 denomination currency notes as legal tender. This article explores the background, reasons, impact, criticisms, government initiatives, and lessons learned from the INR 2000 note ban.

1. Introduction

India, like many other countries, faces challenges related to black money, counterfeit currency, and a cash-dependent economy. In an effort to address these issues, the Indian government decided to introduce a ban on the INR 2000 note.

Table of Contents

2. Background of the INR 2000 Note

The INR 2000 note was introduced as a part of the Indian government’s initiative to tackle corruption, and counterfeiting, and facilitate high-value transactions. Its introduction aimed to reduce the burden of carrying large amounts of cash and promote ease of transactions.

3. The Announcement and Implementation of the INR 2000 Note Ban

The announcement of the INR 2000 note ban took place today by the Indian Prime Minister. It was a surprise move aimed at curbing black money and promoting a digital economy. The ban involved the immediate withdrawal of the INR 2000 notes as legal tender.

4. Reasons for the INR 2000 Note Ban

Curbing Black Money

One of the primary reasons behind the INR 2000 note ban was to curtail the circulation of black money. The large denomination notes were believed to be a favored choice for hoarding unaccounted wealth and facilitating illicit transactions.

Countering Counterfeit Currency

Counterfeit currency is a significant concern for any economy. By discontinuing the INR 2000 notes, the government aimed to curb the circulation of fake currency and protect the integrity of the Indian rupee.

Promoting Digital Payments

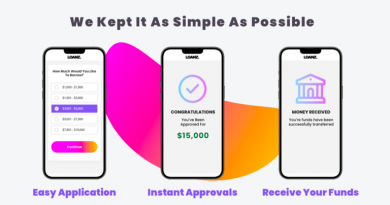

The demonetization move also aimed to promote digital payments and reduce reliance on cash. By removing high-value notes from circulation, the government hoped to encourage people to adopt digital payment solutions and contribute to a cashless economy.

Facilitating Ease of Transactions

Carrying large amounts of cash can be cumbersome and The demonetization move also aimed to facilitate ease of transactions. By encouraging digital payments, individuals and businesses would have a more convenient and efficient means of conducting financial transactions. This would reduce the need for physical cash and improve the overall transaction process.

5. Impact of the INR 2000 Note Ban

The INR 2000 note ban had significant impacts on various aspects of the Indian economy and society.

Short-Term Disruption

Immediately after the announcement, there was a short-term disruption in the economy. The sudden withdrawal of a high denomination note led to confusion and chaos as people rushed to exchange or deposit their INR 2000 notes. Banks and ATMs experienced long queues, and businesses faced challenges in accepting cash payments.

Cash Crunch and Inconvenience

The scarcity of cash caused a temporary cash crunch in the economy. Individuals faced difficulties in accessing their money, and daily transactions were affected. Small businesses, especially those relying heavily on cash transactions, experienced a slowdown in their operations.

Increase in Digital Transactions

One of the intended outcomes of the INR 2000 note ban was to promote digital transactions. In the wake of the cash shortage, there was a significant surge in the adoption of digital payment methods such as mobile wallets, online banking, and card-based transactions. This shift towards digital transactions contributed to the growth of the digital payment ecosystem in India.

Reduction in Black Money Circulation

The ban on the INR 2000 note played a role in reducing the circulation of black money. With the discontinuation of the high denomination note, individuals holding unaccounted wealth in cash faced challenges in converting or depositing their illicit funds. This move helped in curbing the circulation of black money and promoting transparency in financial transactions.

6. Criticisms and Challenges

The INR 2000 note ban was not without its criticisms and challenges.

Effectiveness in Curbing Black Money

Critics argued that the demonetization move did not entirely eliminate black money from the system. While it disrupted existing channels of black money circulation, new avenues for illicit transactions emerged over time. The long-term impact on curbing black money remained a subject of debate.

Counterfeit Currency Concerns

While the demonetization aimed to counter counterfeit currency, skeptics pointed out that counterfeiters could adapt and produce fake currency notes of lower denominations. The focus on eliminating a specific high-value note did not entirely eradicate the counterfeit currency issue.

Reintroduction of High-Denomination Notes

Critics questioned the government’s decision to introduce a higher denomination note, such as the INR 2000, in the first place if its subsequent ban was deemed necessary. The reintroduction of new high-value notes raised concerns about the effectiveness of the demonetization move in achieving its intended objectives.

Impact on Informal Economy and Daily Wage Workers

The cash-dependent informal sector and daily wage workers were significantly affected by the demonetization. With limited access to digital payment methods, these segments faced challenges in carrying out their livelihood activities during the cash shortage period.

7. Government Initiatives and Support

To mitigate the challenges faced during the INR 2000 note ban, the government undertook several initiatives and provided support to various stakeholders.

Demonetization Awareness Campaigns

The government launched extensive awareness campaigns to educate the public about the demonetization move and the benefits of digital transactions. These campaigns aimed to encourage individuals to adopt digital payment methods and navigate the transition smoothly.

Promotion of Digital Payment Solutions

To facilitate the shift towards digital payments, the government promoted and incentivized the use of digital payment solutions

such as mobile wallets, online banking, and UPI (Unified Payments Interface). Various schemes and discounts were introduced to encourage individuals and businesses to embrace digital transactions.

Introduction of New Currency Notes

To address the immediate cash shortage, the government introduced new currency notes of lower denominations, including the INR 500 and INR 200 notes. This helped alleviate the cash crunch and facilitated smoother transactions for the public.

8. Lessons Learned from the INR 2000 Note Ban

The INR 2000 note ban provided valuable lessons for policymakers and the government. These lessons can guide future monetary policy decisions and implementation strategies.

Importance of Adequate Preparation

One key lesson learned was the importance of thorough preparation before implementing significant monetary policy changes. Adequate infrastructure, availability of new currency notes, and awareness campaigns are crucial to minimize disruptions and maximize the effectiveness of such measures.

Balancing Short-Term Disruptions with Long-Term Goals

Another lesson is the need to strike a balance between short-term disruptions and long-term goals. While the INR 2000 note ban caused temporary inconveniences, it aimed to achieve broader objectives such as curbing black money and promoting digital payments. Future policies should consider the potential trade-offs between short-term disruptions and long-term benefits.

Need for Efficient Execution

Efficient execution is crucial for the success of any monetary policy measure. Lessons from the INR 2000 note ban highlight the importance of timely communication, ensuring sufficient cash availability, and seamless implementation across the country.

9. Conclusion

The INR 2000 note ban, or demonetization, was a significant step taken by the Indian government to address challenges related to black money, and counterfeit currency, and promote digital payments. While it had its share of criticisms and challenges, it also led to short-term disruptions and inconveniences. However, the ban played a role in curbing black money, promoting digital transactions, and generating important lessons for future policy decisions.

10. FAQs

- What was the purpose of demonetizing the INR 2000 note? The demonetization aimed to curtail black money, counter counterfeit currency, promote digital payments, and facilitate ease of transactions.

- Did the INR 2000 note ban eliminate black money completely? The demonetization disrupted existing channels of black money circulation but did not entirely eliminate it. The long-term impact on curbing black money is still debated.

- How did the INR 2000 note ban impact the informal economy and daily wage workers? The cash-dependent informal sector and daily wage workers faced challenges during the cash shortage period due to limited access to digital payment methods.

- What initiatives did the government undertake to support the INR 2000 note ban? The government launched awareness campaigns, promoted digital payment solutions, and introduced new currency notes to support the transition.

- What are the lessons learned from the INR 2000 note ban? The importance of adequate preparation, balancing short-term disruptions with long-term goals, and efficient execution were key lessons learned from the INR 2000 note ban.

- For more questions please contact us.